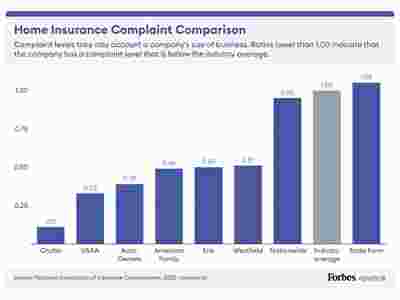

Securing Your Future: Westfield Insurance’s Range of Home Insurance Policies

Securing Your Future: Westfield Insurance’s Range of Home Insurance Policies

As a homeowner, one of your top priorities should be protecting your investment and securing your future. Home insurance is a crucial aspect of safeguarding your home and belongings from unforeseen events. Westfield Insurance understands this and offers a comprehensive range of home insurance policies that cater to your specific needs. In this blog post, we will explore the various home insurance policies provided by Westfield Insurance and how they can help secure your future.

The Importance of Home Insurance

Your home is more than just a building; it’s where you and your loved ones create memories and feel safe. However, no matter how careful you are, accidents or natural disasters can happen unexpectedly. That’s why having reliable home insurance is essential.

Home insurance provides financial protection against damage or loss to your home, personal belongings, and liability for injuries or property damage to others. It helps you recover and rebuild if your home is damaged or destroyed.

Westfield Insurance’s Range of Home Insurance Policies

Westfield Insurance offers a variety of home insurance policies that ensure you have the proper coverage based on your individual needs. Here are the key policies:

1. Homeowners Insurance

Westfield Insurance’s homeowners insurance policy provides protection against property damage, including the house, detached structures, personal belongings, and liability coverage. It safeguards against several perils, such as fire, theft, vandalism, and certain natural disasters.

2. Renters Insurance

If you are a renter, Westfield Insurance’s renters insurance policy is designed to protect your personal belongings from theft, fire, and other covered perils. It also includes personal liability coverage, which provides financial protection if someone gets injured in your rented property.

3. Condo Insurance

For condominium owners, Westfield Insurance’s condo insurance policy offers coverage for the structure, personal belongings, and liability. It protects against perils such as theft, fire, and vandalism. Additionally, it may provide coverage for improvements or alterations you made to your condo.

4. Landlord Insurance

If you own a rental property, Westfield Insurance’s landlord insurance policy is tailored to protect your investment. It covers the structure, liability, and, in some cases, lost rental income. This policy ensures that you are financially safeguarded from property damage, accidents, or lawsuits related to your rental property.

Frequently Asked Questions (FAQs)

Q: How much home insurance coverage do I need?

A: The amount of home insurance coverage you need depends on various factors such as the value of your home, the replacement cost of your belongings, and your liability risks. It’s best to consult with a Westfield Insurance agent who can help you assess your needs and recommend appropriate coverage limits.

Q: Does home insurance cover natural disasters?

A: Home insurance policies typically provide coverage for certain natural disasters, such as fire, lightning, windstorms, and hail. However, coverage for specific events like earthquakes or floods may require additional endorsements or separate policies. Consult with your Westfield Insurance agent to ensure you have adequate coverage.

Q: Can I save money on home insurance?

A: Yes, there are various ways to save money on home insurance. Consider bundling your home insurance with other policies, such as auto insurance, to benefit from multi-policy discounts. Additionally, installing security systems, smoke detectors, and other safety features may qualify you for additional discounts. Talk to your Westfield Insurance agent to explore available options.

By choosing Westfield Insurance’s range of home insurance policies, you are making a smart investment in securing your future. Don’t leave your most valuable assets vulnerable. Get the protection you need today!