How Interac ID is Revolutionizing Peer-to-Peer Transactions

How Interac ID is Revolutionizing Peer-to-Peer Transactions

The Rise of Interac ID

In today’s digital age, peer-to-peer transactions have become an integral part of our lives. Whether it’s splitting a bill with friends, paying for services, or buying products from individual sellers, we often rely on efficient and secure methods for transferring money.

Interac ID is a game-changer in the world of peer-to-peer transactions, offering a seamless and secure way to transfer funds between individuals. Let’s take a closer look at how Interac ID is revolutionizing the way we handle our money.

What is Interac ID?

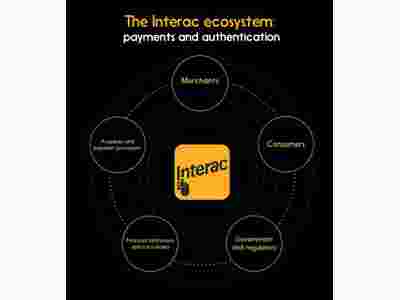

Interac ID is an innovative system that allows users to transfer funds directly from their bank account to another individual’s bank account. It eliminates the need for cash or third-party payment apps, making it incredibly convenient and quick.

Fast, Convenient, and Secure

With Interac ID, transfers are almost instantaneous. Gone are the days of waiting for transactions to clear or worrying about the security of your personal information. Interac ID ensures that your money is safely transferred within seconds, giving you peace of mind.

How Does Interac ID Work?

Using Interac ID is simple and straightforward. All you need is the recipient’s email address or mobile phone number. Once you initiate the transfer, the recipient will receive a notification prompting them to accept the funds. Once accepted, the money is transferred directly to their bank account.

Benefits of Interac ID

Interac ID offers several benefits that are revolutionizing peer-to-peer transactions:

1. Accessibility

Interac ID is widely accepted by most major banks and financial institutions in Canada. This means that you can use it to send money to anyone with a Canadian bank account.

2. Security

Interac ID uses advanced encryption and security measures to ensure that your personal and financial information is kept safe. You can rest assured that your money is being transferred securely.

3. Convenience

Gone are the days of carrying cash or dealing with the limitations of third-party payment apps. With Interac ID, all you need is the recipient’s email address or mobile number to transfer money directly from your bank account.

Frequently Asked Questions (FAQs)

Q: How do I set up Interac ID?

Setting up Interac ID is simple. Contact your bank or financial institution to inquire about their Interac ID service, and they will guide you through the setup process.

Q: Are there any fees associated with using Interac ID?

Most banks or financial institutions do not charge fees for using Interac ID. However, it’s always best to check with your specific bank to confirm if any fees apply.

Q: Can I use Interac ID for international transactions?

Currently, Interac ID is only available for transfers within Canada. For international transactions, you may need to explore other options or services.

Conclusion

Interac ID is revolutionizing peer-to-peer transactions, offering a fast, secure, and convenient way to transfer funds. Say goodbye to cash and the limitations of third-party payment apps – Interac ID has arrived to simplify your transactions. Give it a try, and experience a new level of convenience and security in your financial exchanges.

With Interac ID, peer-to-peer transactions have never been easier or safer. Embrace the future of money transfers and elevate your transaction experience.