Square Payroll: Simplifying Payroll Processing for Small Businesses

Square Payroll: Simplifying Payroll Processing for Small Businesses

Introduction

Running a small business involves juggling various tasks, and one critical aspect that demands utmost attention is payroll processing. Managing payroll can be complex and time-consuming, particularly for small business owners who wear multiple hats. But fear not – Square Payroll is here to simplify your payroll processing woes.

What is Square Payroll?

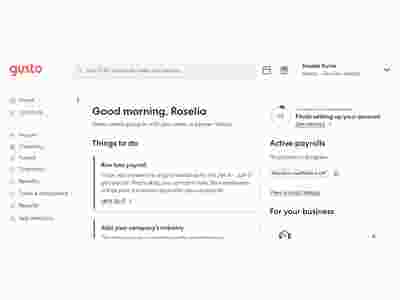

Square Payroll is a user-friendly payroll processing solution designed specifically for small businesses. It streamlines the entire payroll process, from calculating wages to filing taxes, ensuring accuracy and compliance while saving time and effort.

Features of Square Payroll

1. Effortless Employee Management: With Square Payroll, you can easily add, manage, and pay your employees. The platform enables you to set up direct deposits, print checks, and even handle contractor payments, all in one place.

2. Automated Tax Calculations and Filings: Say goodbye to the complexities of tax calculations and filings. Square Payroll automatically withholds the correct taxes from employee paychecks, including state and federal taxes. Additionally, it takes care of Form 941 filings and sends W-2s and 1099s to your employees.

3. Flexible Payroll Schedules: Square Payroll offers flexible payroll schedules, allowing you to choose whether you want to pay your employees weekly, biweekly, or monthly. You can easily set up recurring pay runs, saving you time and ensuring consistent payroll management.

4. Built-in Timecards: Simplify time tracking with Square Payroll’s integrated timecards feature. Employees can clock in and out, and their hours are automatically imported into the payroll system, eliminating the need for manual data entry.

5. Seamless Integration: Square Payroll integrates effortlessly with other Square products, such as Square Point of Sale and Square Team Management, creating a unified ecosystem for your business operations.

Frequently Asked Questions (FAQs)

1. How much does Square Payroll cost?

Square Payroll offers transparent pricing with no hidden fees. The base fee is $29 per month, plus an additional $5 per employee per month. With this pricing structure, you can easily forecast and budget for your payroll expenses.

2. Is Square Payroll suitable for small businesses with only one employee?

Yes, Square Payroll caters to small businesses of all sizes, including those with just one employee. Whether you have a team of one or multiple employees, Square Payroll scales with your business needs.

3. Can Square Payroll accommodate different types of employees, such as contractors?

Absolutely! Square Payroll allows you to seamlessly manage different types of employees, including part-time, full-time, and contractors. You can categorize them appropriately and handle their payments accordingly.

4. Is the data in Square Payroll secure?

Square takes data security seriously. They employ industry-standard encryption and maintain stringent security measures to protect your data. You can trust that your employee and payroll information is in safe hands.

Conclusion

Square Payroll simplifies payroll processing for small businesses. By automating tax calculations, streamlining employee management, and integrating with other Square products, it saves you time, improves accuracy, and ensures compliance. With transparent pricing and robust security measures, Square Payroll is a reliable solution for your payroll needs. Say goodbye to payroll headaches and embrace the simplicity of Square Payroll!